Small Business Optimism Index

Small Business Optimism Index

Overview

The NFIB Research Foundation has collected Small Business Economic Trends data with quarterly surveys since the 4th quarter of 1973 and monthly surveys since 1986. Survey respondents are drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in January 2026.

January 2026: Small Business Optimism Remains Above 52-Year Average

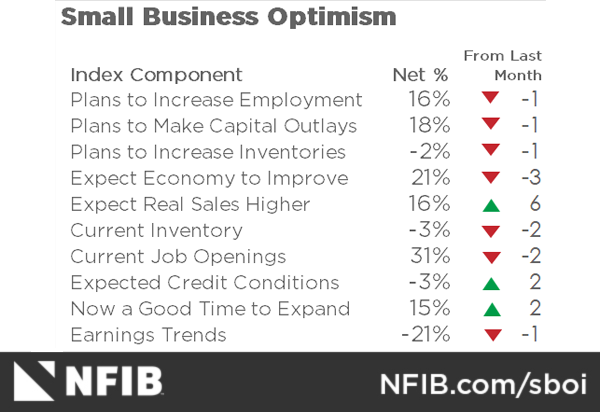

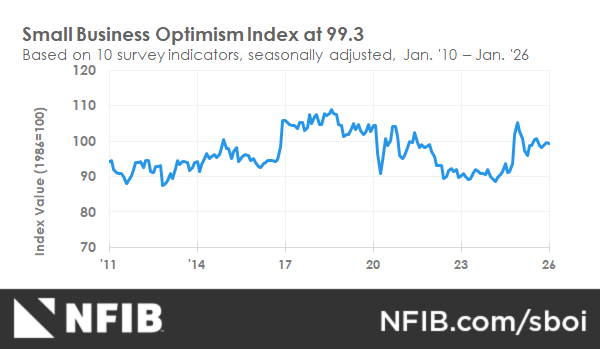

The NFIB Small Business Optimism Index fell 0.2 points in January to 99.3 and remained above its 52-year average of 98. Of the 10 Optimism Index components, three increased and seven decreased. Expected real sales volume was the only component with substantial change, increasing by 6 points. The Uncertainty Index rose 7 points from December to 91. A rise in owners reporting uncertainty about whether it is a good time to expand their business was the primary driver of the rise in the Uncertainty Index.

While GDP is rising, small businesses are still waiting for noticeable economic growth, Despite this, more owners are reporting better business health and anticipating higher sales.

NFIB Chief Economist Bill Dunkelberg

One major highlight of this report is the new NFIB Small Business Employment Index, which translates multiple jobs-related questions into one single number. Currently, this index tells a story of a balanced labor market, coming in about 1.5 points above its historical average (101.6 current vs 100 average).

In conjunction with the January report, NFIB also released a new episode of the NFIB Research Center’s “Small Business by the Numbers” podcast. Listen to the latest episode here.

In January, 13% reported the cost or availability of insurance as their single most important problem, up 4 points from December. The last time insurance reached this percentage was December 2018.

Sixty percent of small business owners reported capital outlays in the last six months, up 4 points from December and the highest level since November 2023.

Sixty percent of small business owners reported capital outlays in the last six months, up 4 points from December and the highest level since November 2023.

In January, a net negative 6% of owners reported paying a higher interest rate on their most recent loan, down 3 points from December. This suggests that credit markets are turning more favorable for small borrowers.

In January, a net negative 6% of owners reported paying a higher interest rate on their most recent loan, down 3 points from December. This suggests that credit markets are turning more favorable for small borrowers.

In January, 16% of small business owners cited labor quality as their single most important problem, down 3 points from December. This is the third consecutive month that labor quality reported as the single most important problem, has declined.

In January, 16% of small business owners cited labor quality as their single most important problem, down 3 points from December. This is the third consecutive month that labor quality reported as the single most important problem, has declined.

The net percent of owners expecting higher real sales volumes over the next quarter rose 6 points from December to a net 16% (seasonally adjusted).

The net percent of owners expecting higher real sales volumes over the next quarter rose 6 points from December to a net 16% (seasonally adjusted).

The net percent of owners reporting inventory gains rose 4 points to a net 3% (seasonally adjusted), the highest reading since January 2023. Not seasonally adjusted, 14% reported increases in stocks (up 1 point), and 17% reported reductions (up 2 points).

The net percent of owners reporting inventory gains rose 4 points to a net 3% (seasonally adjusted), the highest reading since January 2023. Not seasonally adjusted, 14% reported increases in stocks (up 1 point), and 17% reported reductions (up 2 points).

In January, 62% of small business owners reported that supply chain disruptions were affecting their business to some degree, down 2 points from December. Four percent reported a significant impact (up 1 point), 17% reported a moderate impact (down 4 points), 41% reported a mild impact (up 1 point), and 37% reported no impact (up 2 points).

In January, 62% of small business owners reported that supply chain disruptions were affecting their business to some degree, down 2 points from December. Four percent reported a significant impact (up 1 point), 17% reported a moderate impact (down 4 points), 41% reported a mild impact (up 1 point), and 37% reported no impact (up 2 points).

The net percent of owners raising average selling prices fell 4 points from December to a net 26% (seasonally adjusted). Price increases remain well above the historical average of a net 13%, suggesting continued inflationary pressure. Looking forward to the next three months, a net 32% (seasonally adjusted) plan to increase prices, up 4 points from December.

The net percent of owners raising average selling prices fell 4 points from December to a net 26% (seasonally adjusted). Price increases remain well above the historical average of a net 13%, suggesting continued inflationary pressure. Looking forward to the next three months, a net 32% (seasonally adjusted) plan to increase prices, up 4 points from December.

In January, overall reported business health improved from December, with more reporting it as excellent and fewer reporting it as fair. When asked to evaluate the overall health of their business, 14% rated it as excellent (up 5 points), 54% rated it as good (unchanged), 27% rated it as fair (down 7 points), and 4% rated it as poor (up 1 point).

In January, overall reported business health improved from December, with more reporting it as excellent and fewer reporting it as fair. When asked to evaluate the overall health of their business, 14% rated it as excellent (up 5 points), 54% rated it as good (unchanged), 27% rated it as fair (down 7 points), and 4% rated it as poor (up 1 point).

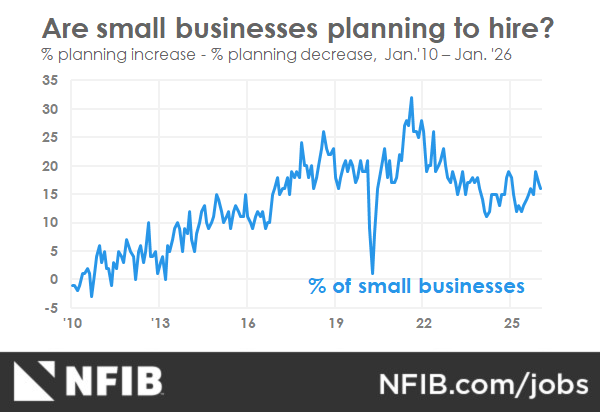

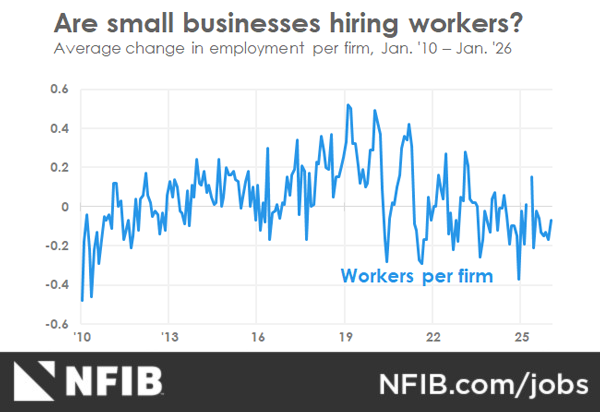

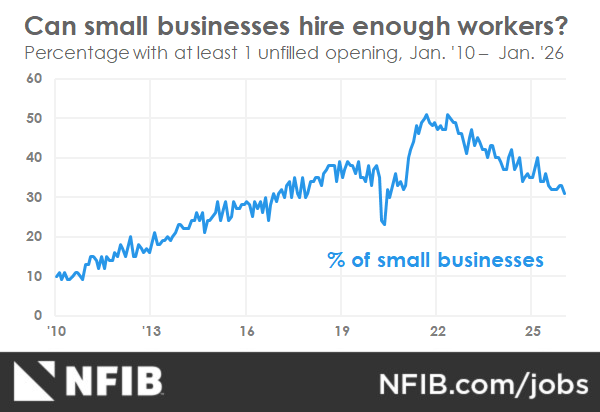

As reported in NFIB’s monthly jobs report, a seasonally adjusted 31% of all small business owners reported job openings they could not fill in January, down 2 points from December. Unfilled job openings remain above the historical average of 24%. Of the 50% of owners hiring or trying to hire in January, 88% reported few or no qualified applicants for the positions they were trying to fill. A seasonally adjusted net 16% of owners plan to create new jobs in the next three months, down 1 point from December.

The NFIB Small Business Employment Index fell nearly 1 point in January to 101.6, erasing about half of the large gain in December, which reached the highest level since March 2025. The Index remains above the historical average of 100, and just slightly above the 2025 average of 101.2.

In January, 16% of small business owners cited labor quality as their single most important problem, down 3 points from December. This is the third consecutive month that labor quality, reported as the single most important problem, has declined. Labor quality reported as the single most important problem was the highest in the construction, manufacturing, and professional services industries, and lowest in wholesale and finance.

Sixty percent of small business owners reported capital outlays in the last six months, up 4 points from December and the highest level since November 2023. Of those making expenditures, 44% reported spending on new equipment (up 7 points), 26% acquired vehicles (down 1 point), and 16% improved or expanded facilities (down 3 points). Thirteen percent spent money on new fixtures and furniture (unchanged), and 5% acquired new buildings or land for expansion (down 2 points). While more small businesses reported making a capital expenditure in January, fewer plan to make a capital expenditure in the next six months. Eighteen percent (seasonally adjusted) plan capital outlays in the next six months, down 1 point from December. Historically, this is a weak reading.

A net negative 6% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, up 2 points from December. Actual sales gains remained below the historical average of a net 0%. The net percent of owners expecting higher real sales volumes over the next quarter rose 6 points from December to a net 16% (seasonally adjusted).

The net percent of owners reporting inventory gains rose 4 points to a net 3% (seasonally adjusted), the highest reading since January 2023. Not seasonally adjusted, 14% reported increases in stocks (up 1 point), and 17% reported reductions (up 2 points). A net negative 3% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in January, down 2 points from December. A net negative 2% (seasonally adjusted) of owners plan inventory investment in the coming months, down 1 point from December.

In January, 62% of small business owners reported that supply chain disruptions were affecting their business to some degree, down 2 points from December. Four percent reported a significant impact (up 1 point), 17% reported a moderate impact (down 4 points), 41% reported a mild impact (up 1 point), and 37% reported no impact (up 2 points).

A seasonally adjusted net 26% of owners reported raising average selling prices in January, down 4 points from December. The incidence of price increases remained well above the historical average of a net 13%, suggesting continued inflationary pressure. Unadjusted, 36% reported higher average prices (up 2 points), and 11% reported lower average selling prices (up 3 points). Looking forward to the next three months, a net 32% (seasonally adjusted) plan to increase prices, up 4 points from December. Twelve percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), unchanged from December.

Seasonally adjusted, a net 32% reported raising compensation, up 1 point from December. A seasonally adjusted net 22% plan to raise compensation in the next three months, down 2 points from December. The frequency of reports of positive profit trends fell 1 point from December to a net negative 21% (seasonally adjusted).

Among owners reporting lower profits, 34% blamed weaker sales, 8% cited the rise in the cost of materials, and 14% cited usual seasonal change. Ten percent reported price change for their product(s) or service(s), and 10% cited labor costs. Among owners reporting higher profits, 58% cited sales volume, 15% cited usual seasonal change, and 11% cited higher selling prices.

A net 3% reported their last loan was harder to get than in previous attempts, down 2 points from December. In January, a net negative 6% of owners reported paying a higher interest rate on their most recent loan, down 3 points from December. The average rate paid on short maturity loans was 9.1% in January, up 0.7 points from December. Twenty-five percent of all owners reported borrowing regularly, unchanged from December.

Overall business health improved in January, with more reporting it as excellent and fewer reporting it as fair. When asked to evaluate the overall health of their business, 14% rated it as excellent (up 5 points), 54% rated it as good (unchanged), 27% rated it fair (down 7 points), and 4% rated it poor (up 1 point). The net percent of owners expecting better business conditions fell 3 points from December to a net 21% (seasonally adjusted).

In January, 15% (seasonally adjusted) reported that it is a good time to expand their business, up 2 points from December. Compared to readings during economic expansions, this is not a strong reading.

In January, 18% of small business owners reported taxes as their single most important problem, down 2 points from December and ranking as the top problem. This suggests that the less consistent issues (labor quality, inflation, poor sales, etc.) are not currently in a bad state.

The percent of small business owners reporting labor quality as the single most important problem for their business fell 3 points from December to 16%. This is the third consecutive month that labor quality, reported as the single most important problem, has declined. Labor costs reported as the single most important problem for business remained at 9%.

Thirteen percent of small business owners reported the cost or availability of insurance was their single most important problem in January, up 4 points from December. The last time insurance reported as the single most important problem, was this high was December 2018.

Twelve percent of owners reported that inflation was their single most important problem in operating their business, unchanged from December. The percent of small business owners reporting government regulations and red tape as their single most important problem rose 2 points to 9%.

The percent of small business owners reporting poor sales as their top problem fell 1 point to 9%. Six percent reported competition from large businesses as their single most important problem, unchanged from December. Three percent reported that financing and interest rates were their top business problem in January, unchanged from December.

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in January 2026.

Labor Market

The Employment Index fell nearly 1 point in January to 101.6, erasing about half of the large gain in December, which reached the highest level since March 2025. The Index remains above the historical average of 100, and just slightly above the 2025 average of 101.2. In January 31% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down 2 points from December. Twenty-five percent had openings for skilled workers (down 3 points), and 10% had openings for unskilled labor (unchanged). A seasonally adjusted net 16% of owners plan to create new jobs in the next three months, down 1 point from December. Overall, 50% reported hiring or trying to hire in January, down 3 points from December and the lowest reading since May 2020. Forty-four percent (88% of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill (down 4 points). Twenty-five percent of owners reported few qualified applicants for their open positions (unchanged), and 19% reported none (down 4 points). In January, 16% of small business owners cited labor quality as their single most important problem, down 3 points from December. Labor quality reported as the single most important problem was the highest in the construction, manufacturing, and professional services industries, and lowest in wholesale and finance. Thirty percent of small businesses in the construction industry reported labor quality as their single most important problem, 14 points higher than for all firms. Only 2% of businesses in the finance industry reported labor quality as their single most important problem. Labor costs reported as the single most important problem for business owners, remained at 9%.

Capital Spending

Sixty percent of small business owners reported capital outlays in the last six months, up 4 points from December and the highest level since November 2023. Of those making expenditures, 44% reported spending on new equipment (up 7 points), 26% acquired vehicles (down 1 point), and 16% improved or expanded facilities (down 3 points). Thirteen percent spent money on new fixtures and furniture (unchanged), and 5% acquired new buildings or land for expansion (down 2 points). Eighteen percent (seasonally adjusted) plan capital outlays in the next six months, down 1 point from December.

Inflation

The net percent of owners raising average selling prices fell 4 points from December to a net 26% (seasonally adjusted). The incidence of price increases remained well above the historical average of a net 13%, suggesting continued inflationary pressure. Unadjusted, 36% reported higher average prices (up 2 points), and 11% reported lower average selling prices (up 3 points). Looking forward to the next three months, a net 32% (seasonally adjusted) plan to increase prices, up 4 points from December. Twelve percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), unchanged from December.

Credit Markets

A net 3% reported their last loan was harder to get than in previous attempts, down 2 points from December. In January, a net -6% of owners reported paying a higher interest rate on their most recent loan, down 3 points from December. This suggests that credit markets are turning more favorable for small borrowers. The average rate paid on short maturity loans was 9.1% in January, up 0.7 points from December. Twenty-five percent of all owners reported borrowing regularly, unchanged from December.

Compensation and Earnings

Seasonally adjusted, a net 32% reported raising compensation, up 1 point from December. A seasonally adjusted net 22% plan to raise compensation in the next three months, down 2 points from December. The frequency of reports of positive profit trends fell 1 point from December to a net -21% (seasonally adjusted). Among owners reporting lower profits, 34% blamed weaker sales, 8% cited rising material costs, and 14% cited the usual seasonal change. Ten percent cited price change from their product(s) or service(s), and 10% cited labor costs. Among owners reporting higher profits, 58% cited sales volume, 15% cited usual seasonal change, and 11% cited higher selling prices.

Sales and Inventories

A net -6% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, up 2 points from December. Actual sales gains remained below the historical average of a net 0%. The net percent of owners expecting higher real sales volumes over the next quarter rose 6 points from December to a net 16% (seasonally adjusted). The net percent of owners reporting inventory gains rose 4 points to a net 3% (seasonally adjusted), the highest reading since January 2023. Not seasonally adjusted, 14% reported increases in stocks (up 1 point), and 17% reported reductions (up 2 points). A net – 3% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in January, down 2 points from December. A net -2% (seasonally adjusted) of owners plan inventory investment in the coming months, down 1 point from December. In January, 62% of small business owners reported that supply chain disruptions were affecting their business to some degree, down 2 points from December. Four percent reported a significant impact (up 1 point), 17% reported a moderate impact (down 4 points), 41% reported a mild impact (up 1 point), and 37% reported no impact (up 2 points).

Outlook

In January, overall reported business health improved from December, with more reporting it as excellent and fewer reporting it as fair. When asked to evaluate the overall health of their business, 14% rated it as excellent (up 5 points), 54% rated it as good (unchanged), 27% rated it as fair (down 7 points), and 4% rated it as poor (up 1 point). The net percent of owners expecting better business conditions fell 3 points from December to a net 21% (seasonally adjusted). In January, 15% (seasonally adjusted) reported that it is a good time to expand their business, up 2 points from December. Compared to readings during economic expansions, this is not a strong reading.

Single Most Important Problem

In January, 18% of small business owners reported taxes as their single most important problem, down 2 points from December and ranking as the top problem. Taxes ranking as the top issue is typically a sign that other, less consistent issues (labor quality, inflation, poor sales, etc.) are not currently in a bad state. The percent of small business owners reporting labor quality as the single most important problem for their business fell 3 points from December to 16%.This is the third consecutive month that labor quality, reported as the single most important problem, has declined. Labor costs reported as the single most important problem for business remained at 9%. In January, 13% reported the cost or availability of insurance as their single most important problem, up 4 points from December. The last time insurance, reported as the single most important problem, was this high was December 2018. Twelve percent of owners reported that inflation was their single most important problem in operating their business, unchanged from December. The percent of small business owners reporting government regulations and red tape as their single most important problem rose 2 points to 9%. The percent of small business owners reporting poor sales as their top business problem fell 1 point to 9%. Six percent reported competition from large businesses as their single most important problem, unchanged from December. Three percent reported that financing and interest rates were their top business problem in January, unchanged from December.

Commentary

Overview

According to the official statistics, the economy is performing well. GDP is rising smartly while inflation remains relatively low and stable, as does the unemployment rate. Focusing on GDP, the economy is flying. A 4.2% gain in the latest release (Q3 2025) suggests we are in the middle of a boom. But meanwhile, small business owners aren’t “feeling the gain,” or at least not at that level of economic growth.

The NFIB Small Business Optimism Index hovers just above its historical average. The new Employment Index tells a similar story, with numbers just above their historical average, suggesting a balanced labor market, not a booming one. The official statistics show one story of the economy and small businesses show a more moderated one.

The “confusion” stems from the details of what GDP really means. This includes consumer spending, government purchases of goods and services, and investment (the creation of new productive assets). For example, new data center construction is booming to support AI growth. As such, one sector could be taking off, while most of the economy is more balanced. Major investment-led growth of one sector is not necessarily shared, and especially not right away. Bottom line, GDP growth is strong, but not equally distributed across the economy. Let’s see if 2026 brings more balance to these trends.

Quotes from NFIB Members

“Unsure about how the next few months will go, but we are moving forward hopeful that the overall economy does well. We are excited for the future, but with caution.” -Retail, AZ

“Insurance costs- business/liability, and health are having significant increases affecting uncertainty in pricing product.” – Construction, OR

“The uncertainty of economic change has people not spending as much or not buying unnecessary products. In addition, tariffs and inflation have caused significant delays in product and increased the prices greatly.” – Construction, WA

“This country suffers from lack of skilled workers. It is almost impossible to find skilled workers in the automotive repair field.” – Services, MI

“Our business has been open since 1968. We are obviously doing something right for our customers. My struggle is passing on the increase in the cost of goods to my customers. That is a daily fight. I have to do it.” – Manufacturing, MI

“Obtaining timely city/county permits is a nightmare. Takes months if not years for permits. Insurance eats up any profits, it just keeps going up and in our business we have limited sources that will insure us.” – Construction, CA

“All my overhead has gone up significantly. My ability to raise my prices is negatively impacted by all the increased demands on my client’s “discretionary” income. Less taxes, less regulations, less bureaucracy, are the best help to my business and business prospects. Drastically less government spending and reduction of debt.” – Professional services, KS