Small business owners know that employees are their most valuable resource. Small business owners work hard to train and retain employees by creating a rewarding workplace. Finding qualified employees has been small business owners’ top business problem since 2019. However, government mandates and regulations have made labor issues and the ability to fill open positions more complicated than ever.

Small businesses operate differently than large businesses; they do not have human-resources departments to track the changing standards and rules that affect their workforce and workplace.

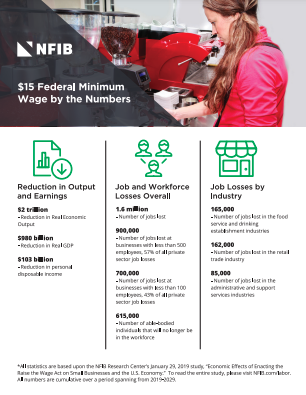

NFIB urges Congress to eliminate burdensome mandates and prevent cumbersome regulations that inhibit job creation.