Topics:

March 4, 2022

Legislature Adjourns on a Couple of High Notes for Small Business

State Director Anthony Smith reports from Salem on the small-business agenda following the Legislature’s March 4 adjournment

It’s Day 32 of the 35-day 2022 Oregon Legislative Session, and I’m pleased to report that the Oregon Legislative Assembly has adjourned sine die. You can expect to see a full post-session report from me within the next week, but for now, I just want to express my thanks to everyone who reads these updates. From our Oregon Leadership Council members to all the NFIB staff that is involved in making our state program a success, we couldn’t do this important work without your support. With the exception of HB 4002, the agricultural overtime bill that passed and is now on its way to Gov. Brown’s desk, small business fared well in the 2022 short session. With ample financial resources available to budget writers, there was little to no pressure to raise taxes on Oregon businesses. In fact, with the passage of SB 1524 – a bill supported by NFIB this session – overall state revenues were slightly reduced. Among other provisions, this omnibus tax bill provides for a new temporary exemption from the state’s Corporate Activity Tax (CAT) for prescription drug sales at local independent pharmacies with nine or fewer locations under common ownership. In other news, the omicron wave finally appears to be over for the West Coast – and Gov. Brown has announced that Oregon will join Washington and California in lifting the state’s indoor mask mandate on Saturday, March 12. Originally, the Oregon Health Authority was predicting that COVID-19 hospitalizations would not decrease to fewer than 400 statewide until the end of March, but case counts have plummeted in recent weeks and that metric is expected to be reached today. This is very welcome news! More to come next week, but that’s it for now – as always, please let me know if you have any questions or comments! Prior Legislative Report- February 25—Agricultural Overtime, Omnibus Tax Bills Advance

- February 11—Proposal Instituting a Sales Tax on Certain Good Dead for the Year

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

April 28, 2025

NFIB Illinois Opposes Inclusion of Mileage-Tax Pilot Program in…

HB 2963 includes a vehicle-mileage-tax pilot program for Illinois

Read More

April 28, 2025

Main Street Presses for Tort Reform, Tax Relief at Small Busine…

Small business owners from around the state will gather at the State House.

Read More

April 28, 2025

NFIB Arizona Making Final Push on Two Priority Bills

Business personal property tax exemption, litigation transparency close to…

Read More

April 28, 2025

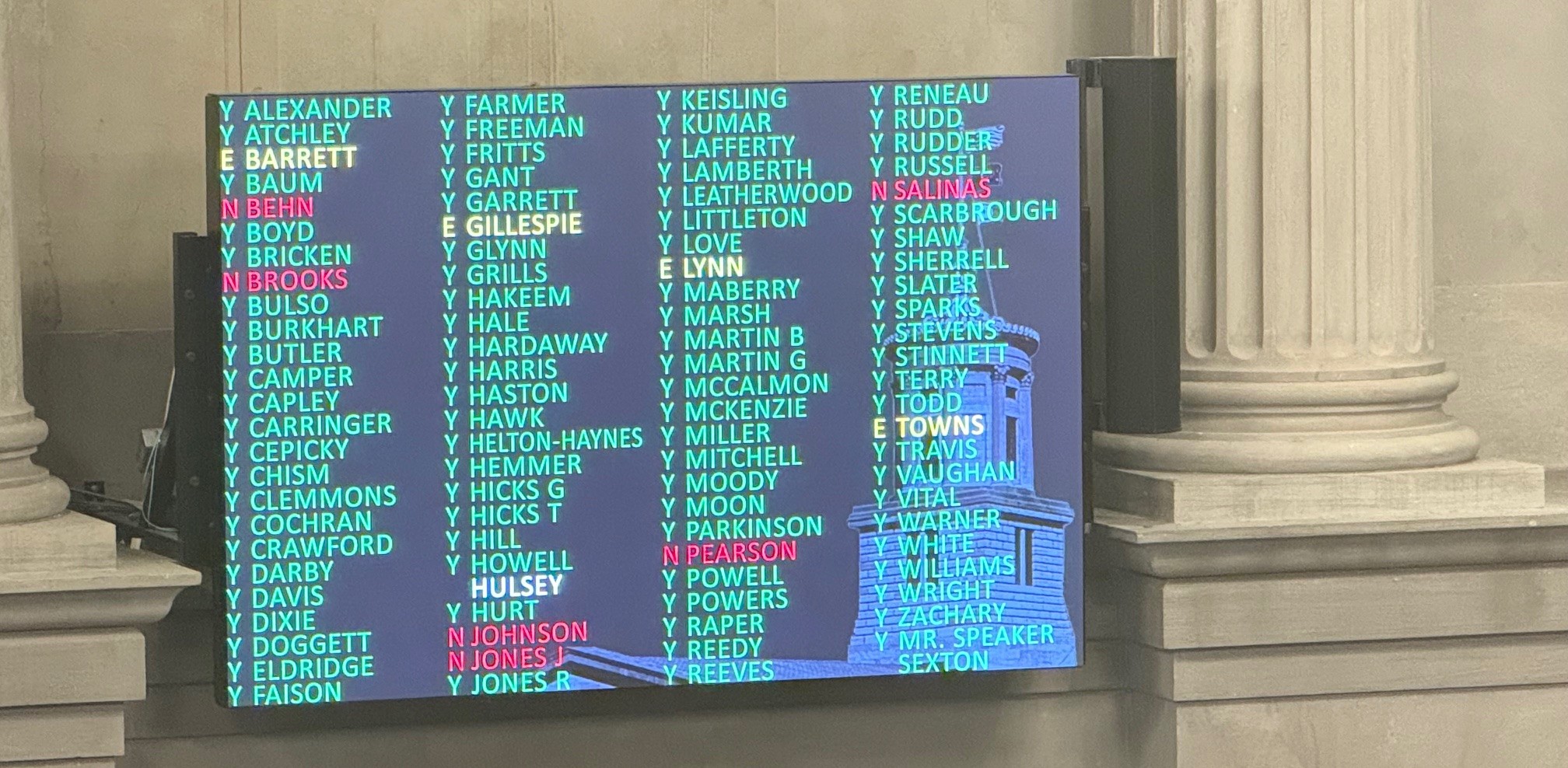

What You Need to Know About the 2025 Session in Tennessee

Legislature Adjourns: Big wins for small business, important updates to sta…

Read More