NFIB has joined other business groups in a coalition to oppose the proposed state constitutional to allow a progressive income tax in Illinois. Other members of the coalition include the Illinois Chamber of Commerce, Illinois Farm Bureau, and Technology & Manufacturing Association.

Take action to help defeat the progressive tax.

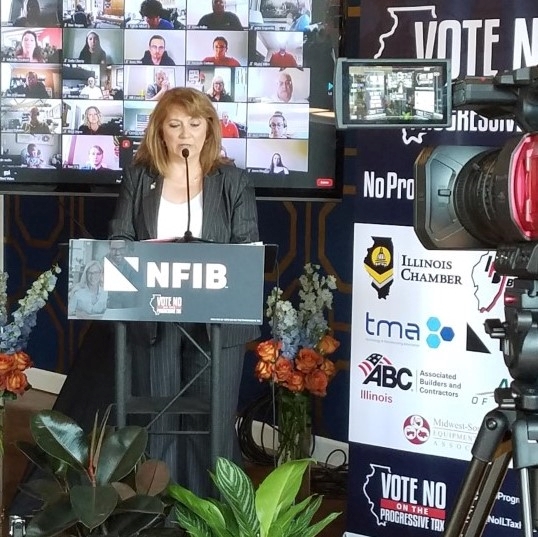

Representatives of the coalition held simultaneous press conferences at four locations throughout Illinois to call attention to the groups who would be hurt most by the progressive income tax: small businesses, farmers, manufacturers, and workers.

Speaking at the news conference held at LeFleur Floral Design + Boutique, an NFIB member business in Washington, NFIB Illinois Leadership Council Chair Cindy Neal said, “Let us not forget that Illinoisans already pay the second-highest property taxes in the nation, and these local taxes increase every single year.

“We pay three to four times the property taxes of our neighbors in Indiana and Wisconsin, and our taxes go up every year even though property values are stagnant,” she said. “This progressive tax will do nothing to address our biggest problem in Illinois: our sky-high property tax burden. It simply piles additional taxes onto already overburdened Illinois taxpayers. All of these taxes have serious and real-life consequences for our families and small businesses, especially as we struggle to recover from COVID-19.”

NFIB State Director Mark Grant said, “If approved by voters in the November election, Governor Pritzker’s progressive tax is going to harm small businesses and their employees.

“It would eliminate the state constitution’s flat tax protection and create multiple tax brackets and rates,” Grant said. “That means the more you earn, the higher your tax rate. And unlike our current tax law, the income brackets and tax rates could be changed by a simple majority any time lawmakers feel the need to increase revenue.

“Based on past experience, there’s a real concern that the General Assembly will continue to pass tax increases in the coming years so they can keep spending on new programs without fixing the deficit,” Grant said. “Small business owners understand that the General Assembly has to address Illinois’ financial calamity but raising taxes without making major spending reforms won’t make things better.”