October 10, 2024

Beware Aggressive Marketing for Minnesota’s New Retirement Plan Mandate

Minnesota small business owners may recall that, in 2023, state lawmakers passed a new mandate called the Secure Choice Retirement Program (SCRP).

This program requires all employers with five or more employees to either i) offer their own employer-sponsored retirement plan to employees or ii) automatically enroll their employees in the state-run retirement plan known as SCRP.

We’ve become aware of aggressive pushes from large payroll management firms urging small business owners to sign up for their retirement plan. These marketing pitches incorrectly suggest the SCRP mandate begins on January 1, 2025.

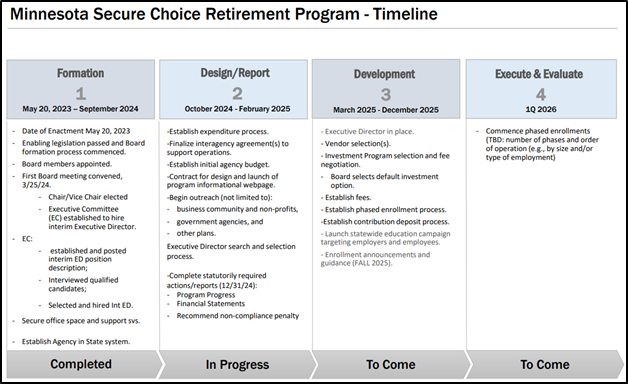

NFIB MN recently met with the SCRP board chair and staff, who explained that the SCRP mandate will NOT go into effect for employers of any size on January 1, 2025.

At this time, SCRP will not start until January 1, 2026, at the earliest.

Source: Minnesota Secure Choice Retirement Program Board of Directors Meeting, 10/4/2024

The SCRP law requires the program to be opened in at least two phases, with the final phase occurring no later than two years after the initial phase.

NFIB MN opposed the SCRP law and continues to advocate for delaying the mandate’s implementation for as long as possible. While we won the exemption for the smallest employers (with 1-4 employees), we also continue to push for increasing the mandatory participation threshold and exempting more small businesses.

We’ll provide more updates to our members on the implementation timeline as more information becomes available.

Learn more about SCRP here: Secure Choice Retirement Plan – LCPR

Background on the Secure Choice Retirement Program:

Once fully implemented, the SCRP requires that employers with five or more employees who do not sponsor an employee retirement savings plan facilitate enrollment of employees in a state-facilitated individual retirement account program.

Employees may opt out of participating by giving notice to their employer. Employers who continue or begin sponsoring their own plan will be exempt.

The SCRP will be operated by a seven-person board comprised of state officials, gubernatorial appointees, and members appointed by the Minnesota Legislative Commission on Pensions and Retirement.

The program will be opened in a minimum of two phases. The board is responsible for developing investment options, establishing a default investment option, setting minimum contribution rates and an auto-escalation schedule, establishing a system for facilitating payroll deductions, and more.

Employer obligations under this program include:

- providing board-prepared information to employees on the program at least 30 days prior to the first paycheck from which deductions could be withheld;

- automatically enrolling employees in the program unless the employee opts not to participate; and

- facilitating the transfer of participating employee contributions via payroll deduction or the mechanism established by the board.

Several other states have passed laws establishing or are already operating a similar state-facilitated retirement program. To get a sense of what the Minnesota version may be like, you can see the Illinois Secure Savings program here, which began operations in 2018: Illinois Secure Choice (ilsecurechoice.com).

Read the full Secure Choice Retirement Plan law here: Ch. 187 MN Statutes

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles