Topics:

August 30, 2023 Last Edit: June 5, 2025

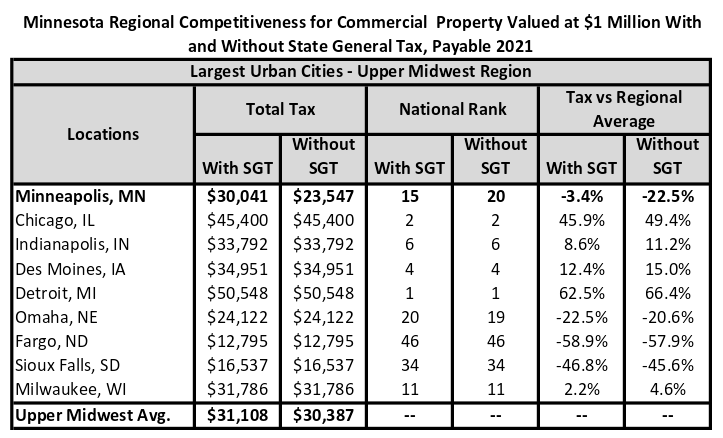

Commercial Property Taxes Much Higher Than Region, Nation.

New Report: Minnesota Property Tax System Soaks Small Businesses

Source: Minnesota Center for Fiscal Excellence

As bad as the property tax disparity for commercial parcels is now, it will get worse going forward thanks to “reforms” enacted by Governor Walz and the DFL-controlled Legislature. This year’s Omnibus Tax Bill shifted more of the local property tax burden onto businesses by increasing the exclusion level for residential property.

Minnesota’s property tax system includes “unique” features like the Statewide General Property Tax Levy, which can add 20% or more to a commercial/industrial property bill. It’s one of only 16 statewide property taxes in the country and the only one to exclusively tax all C/I property for general purpose appropriations.

NFIB Minnesota has seen success in cutting the Statewide General Property Levy in recent years, and we will continue fighting to reduce the property tax burden on small business owners.

Source: Minnesota Center for Fiscal Excellence

As bad as the property tax disparity for commercial parcels is now, it will get worse going forward thanks to “reforms” enacted by Governor Walz and the DFL-controlled Legislature. This year’s Omnibus Tax Bill shifted more of the local property tax burden onto businesses by increasing the exclusion level for residential property.

Minnesota’s property tax system includes “unique” features like the Statewide General Property Tax Levy, which can add 20% or more to a commercial/industrial property bill. It’s one of only 16 statewide property taxes in the country and the only one to exclusively tax all C/I property for general purpose appropriations.

NFIB Minnesota has seen success in cutting the Statewide General Property Levy in recent years, and we will continue fighting to reduce the property tax burden on small business owners.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

March 2, 2026

TAKE ACTION: Urge Governor Lujan Grisham to Stop the Business Tax Hike

Take action today and tell the Governor to line-item veto the tax increase in SB 151.

Read More

March 2, 2026

NFIB Launches Radio, Digital Ads to Stop State Income Tax

Small businesses oppose new “Millionaire Tax” on Main Street

Read More

March 2, 2026

Take Action: Help Stop Increased UI Taxes on Maryland Small Businesses

Urge your lawmakers to reject this bad policy

Read More

March 2, 2026

Tax Relief, Workforce Development Top NFIB’s LA Legislative Agenda

This year’s legislative session will begin on March 9.

Read More