Record uncertainty hanging over nation’s Main Streets

FOR IMMEDIATE RELEASE

Contact: John Kabateck, California State Director, [email protected]

or Tony Malandra, Senior Media Manager, [email protected]

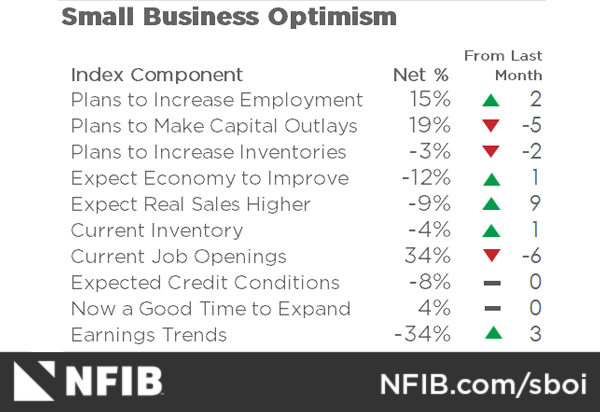

SACRAMENTO, Calif., Oct. 8, 2024—A double dose of bad news sprung from the latest Optimism Index released today by the National Federation of Independent Business (NFIB). To little surprise, the Index showed a 33rd consecutive month below its 50-year average, but its uncertainty component raised more than a few eyebrows, rising 11 points to 103—the highest reading ever recorded.

“Small business owners are desperate to cling to any good news they can and finding nothing to grasp,” said John Kabateck, state director for NFIB in California. “I give equal blame to Congress for dragging its feet on making the Small Business Deduction permanent, and to California for – where to start? – passing new laws curbing the free-speech rights of employers, imposing new requirements on independent contractors, adding new unlawful employment practices, knitting a crazy quilt of minimum-wage laws, and requiring workplace violence prevention plans from every employer no matter the need, time required or paperwork involved. Have the time? I have more. Hopefully, things have gotten so rock bottom with small business and working families that it will motivate voters to make positive changes at the ballot box this November.”

From NFIB Chief Economist Bill Dunkelberg

“Small business owners are feeling more uncertain than ever. Uncertainty makes owners hesitant to invest in capital spending and inventory, especially as inflation and financing costs continue to put pressure on their bottom lines. Although some hope lies ahead in the holiday sales season, many Main Street owners are left questioning whether future business conditions will improve.”

Other Highlights from the Latest SBET Report

- The average rate paid on short maturity loans was 10.1%, up 0.6 of a point from August. The last time it was this high was February 2001.

- Thirty-four percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down six points from August and the lowest reading since January 2021.

- Seasonally adjusted, a net 32% reported raising compensation, down one point from August and remaining the lowest reading since April 2021.

- Twenty-three percent of owners reported that inflation was their single most important problem in operating their business (higher input and labor costs), down one point from August but remaining the top issue.

NFIB’s monthly (SBET) report is the gold standard measurement of America’s small business economy. Used by the Federal Reserve, Congressional leaders, administration officials, and state legislatures across the nation, it’s regarded as the bellwether on the health and welfare of the Main Street enterprises that employ half of all workers, generate more net new jobs than large corporations, and gave most of us the first start in our working life. The SBET (aka the Optimism Index) is a national snapshot of NFIB-member, small-business owners not broken down by state. More about the Uncertainty Index can be read here. The typical NFIB member employs between one and nine people and reports gross sales of about $500,000 a year.

Keep up with the latest California small-business news at www.nfib.com/CA. Follow us on X @NFIB_CA and on Facebook, https://www.facebook.com/NFIB.CA

###

For 80 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since our founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB California

915 L St. Ste C-411

Sacramento, CA 95814

916-448-9904

NFIB.com/CA

Twitter: @NFIB_CA