“Their views about future business conditions are at the worst levels seen in 50 years.”

FOR IMMEDIATE RELEASE

Contact: John Kabateck, California State Director, 916-956-9027, [email protected]

or Tony Malandra, Senior Media Manager, 415-640-5156, [email protected]

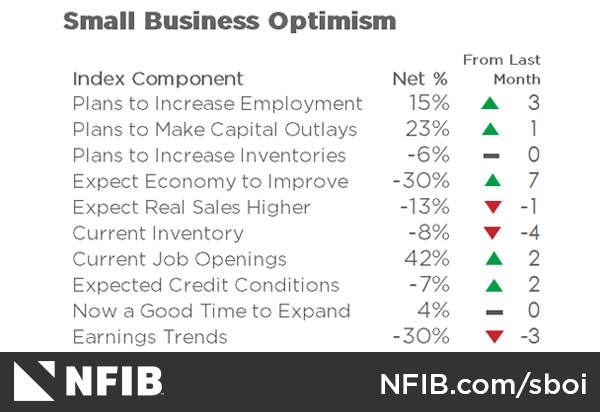

SACRAMENTO, Calif., June 11, 2024—At first glance not much has changed in the latest monthly poll of the nation’s small business owners released today by their largest and leading association. Inflation remains the top concern, but one component, the Uncertainty Index, rose an alarming nine points to 85, the highest reading since November 2020.

“The small business sector is responsible for the production of over 40% of GDP and employment, a crucial portion of the economy,” said Bill Dunkelberg, chief economist for the National Federation of Independent Business (NFIB), which publishes the Small Business Economic Trends (SBET) report. “But for 29 consecutive months, small business owners have expressed historically low optimism and their views about future business conditions are at the worst levels seen in 50 years. Small business owners need relief as inflation has not eased much on Main Street.”

NFIB’s monthly (SBET) report is the gold standard measurement of America’s small business economy. Used by the Federal Reserve, Congressional leaders, administration officials, and state legislatures across the nation, it’s regarded as the bellwether on the health and welfare of the Main Street enterprises that employ half of all workers, generate more net new jobs than large corporations, and gave most of us the first start in our working life. The SBET (aka the Optimism Index) is a national snapshot of NFIB-member, small-business owners not broken down by state. More about the Uncertainty Index can be read here. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year.

“California is exacerbating matters,” said NFIB State Director John Kabateck, “by bogging down small business owners in a morass of varying minimum-wage rates, threatening to spike their unemployment insurance taxes by adding workers with jobs to the rolls of the unemployed, and yoking onto their backs even more environmental, paid leave, and other regulatory costs. And this goes without mentioning the cost of cleaning up and replacing inventory from retail thefts the state is finally and reluctantly getting around to addressing.”

Note to Reporters—Kabateck is in Washington, D.C. this week to help lobby Congress on a couple of big ways it can help the nation’s small businesses.

Keep up with the latest on California small-business news at www.nfib.com/california or by following NFIB on Twitter @NFIB_CA or on Facebook @NFIB.CA.

###

For 80 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since its founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB California

915 L St. Ste C-411

Sacramento, CA 95814

916-448-9904

NFIB.com/CA

Twitter: @NFIB_CA