NFIB state director calls on Montana delegation to lead the way to a Main Street recovery

FOR IMMEDIATE RELEASE

Contact: Ronda Wiggers, Montana State Director, [email protected]

or Tony Malandra, Senior Media Manager, 415-640-5156, [email protected]

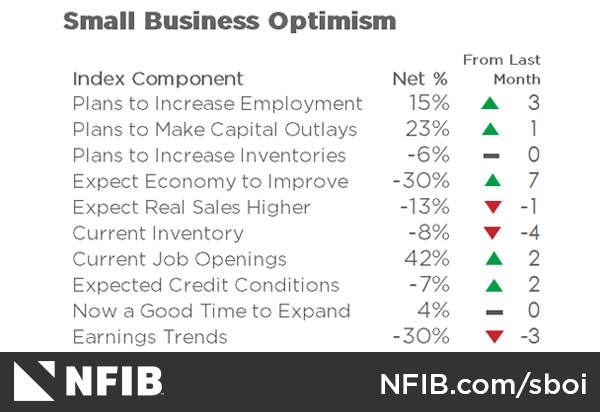

HELENA, Mont., June 11, 2024—Today’s release of NFIB’s monthly Small Business Economic Trends report didn’t vary much from previous dismal ones, but it did reveal a more troubling finding that prompted the Montana state director for the association that publishes it to call on the state’s Congressional delegation to act faster on two issues that would help reverse small businesses’ slide.

“The small business sector is responsible for the production of over 40% of GDP and employment, a crucial portion of the economy,” said Bill Dunkelberg, chief economist for NFIB. “But for 29 consecutive months, small business owners have expressed historically low optimism and their views about future business conditions are at the worst levels seen in 50 years.”

Ronda Wiggers, NFIB’s Montana state director, said it’s time for Congress to act. “I’m very proud of our State Legislature for not exacerbating a very serious problem but instead initiating helpful measures to ease the problems of small businesses. I wish Congress would do the same. It needs to act now on two issues that would greatly help with a national recovery along the Main Streets of the nation. I commend Sen. Steve Daines and Congressman Ryan Zinke for their leadership on one of the issues and ask Sen. Jon Tester and Congressmen Matt Rosendale to join them in not letting the Small Business Deduction expire. Then, I’d like all four to unify in freeing Main Street, mom-and-pop companies from the vise grip of the Corporate Transparency Act.”

In a guest editorial in The Washington Times, which preceded NFIB’s Fly-In week of small business lobbying activities, NFIB President Brad Close described the consequences of both issues.

“The first and most important thing Congress should do is cut small businesses’ taxes permanently,” wrote Close. “The small-business deduction — the small-business centerpiece of the 2017 tax cuts — expires next year. If lawmakers allow that to happen, Main Street will face an unprecedented tax hike. At least half of the nation’s small businesses are uncertain about their future. They’re holding back when they want to be ramping up. With disaster already beginning to unfold, Congress should act immediately.

“… The second thing Congress should do is end a particularly burdensome mandate — the ‘beneficial ownership’ reporting requirement. Created in 2021 and enforced since January, it’s 100% targeted at the smallest of small businesses, wrapping them in red tape while giving big business a pass.

“Under this mandate, more than 32 million small businesses must regularly send private personal information about their owners to a federal database. If they don’t, they face up to two years in prison and a $10,000 fine. Would any member of Congress like to tell a small-business owner that they deserve to go to prison over this?”

Click here to read the full Washington Times guest editorial.

NFIB’s monthly (SBET) report is the gold standard measurement of America’s small business economy. Used by the Federal Reserve, Congressional leaders, administration officials, and state legislatures across the nation, it’s regarded as the bellwether on the health and welfare of the Main Street enterprises that employ half of all workers, generate more net new jobs than large corporations, and gave most of us the first start in our working life. The SBET (aka the Optimism Index) is a national snapshot of NFIB-member, small-business owners not broken down by state. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year.

Keep up with the latest on Montana small business at www.nfib.com/MT.

###

For 80 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since its founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB Montana

406-899-9659

[email protected]

www.nfib.com/montana

Twitter: @NFIB_MT