March 17, 2025

State House Items

Notable Legislation

- Amend the Laws Governing Paid Family and Medical Leave (LD 894, MDOL bill)

- Enact the Maine Consumer Data Privacy Act (LD 1088)

- Establish a 4% Surtax on Incomes of Above $1,000,000 to Fund 55% of the State’s Share of Education (LD 1089)

https://legislature.maine.gov/

Higher Income Tax Sought

Advocates for restoring higher income taxes are proposing legislation that is a variation of a 2016 referendum proposal. LD 1089 would impose a 4% surtax in taxable incomes above $1,000,000 and use the revenues to support State funding of local education costs. As proposed, LD 1089 would make Maine second only to California for the highest state tax rate on taxable incomes over $1 million.

The 2016 referendum was narrowly passed by 9,580 votes and subsequently repealed in the 2017 legislative session. NFIB was part of a coalition that strongly opposed the 2016 referendum question.

NFIB will strongly oppose LD 1089.

Paid Family & Medical Leave

New information posted on the PFML website includes:

- Frequently Asked Questions Update (Employer resources)

- Insurance Carriers & Plans Certified as Substantially Equivalent (Employer resources)

- Estimating Your PFML Premium & Benefits Chart (Employee Resources)

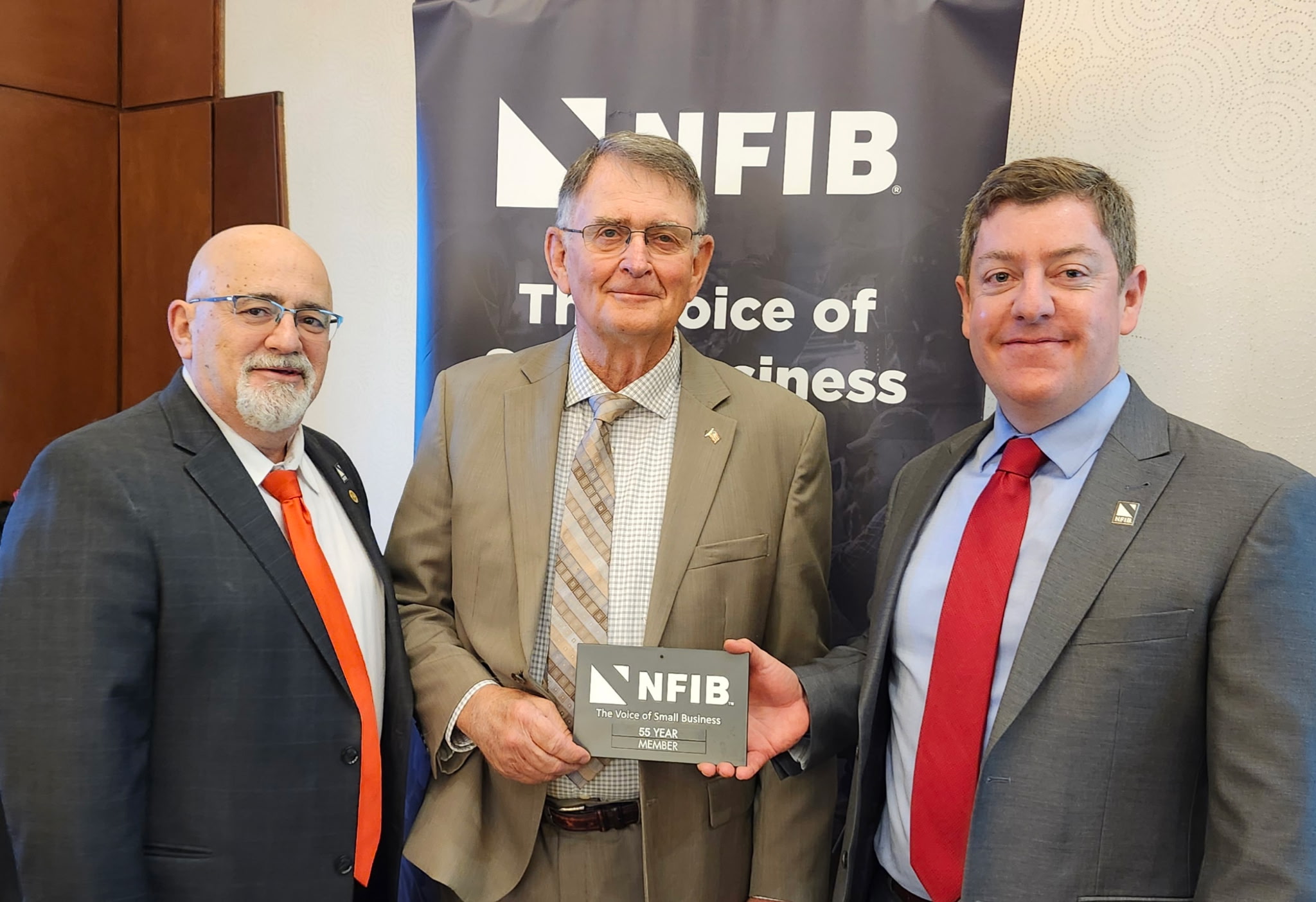

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles