Topics:

May 13, 2024

NFIB Launches Iowa Radio Ad Campaign Thanking Senators Chuck Grassley and Joni Ernst for Supporting Small Business Deduction

TAKE ACTION: Tell your lawmakers to make the 20% Small Business Deduction permanent: https://www.nfib.com/advocacy/now/

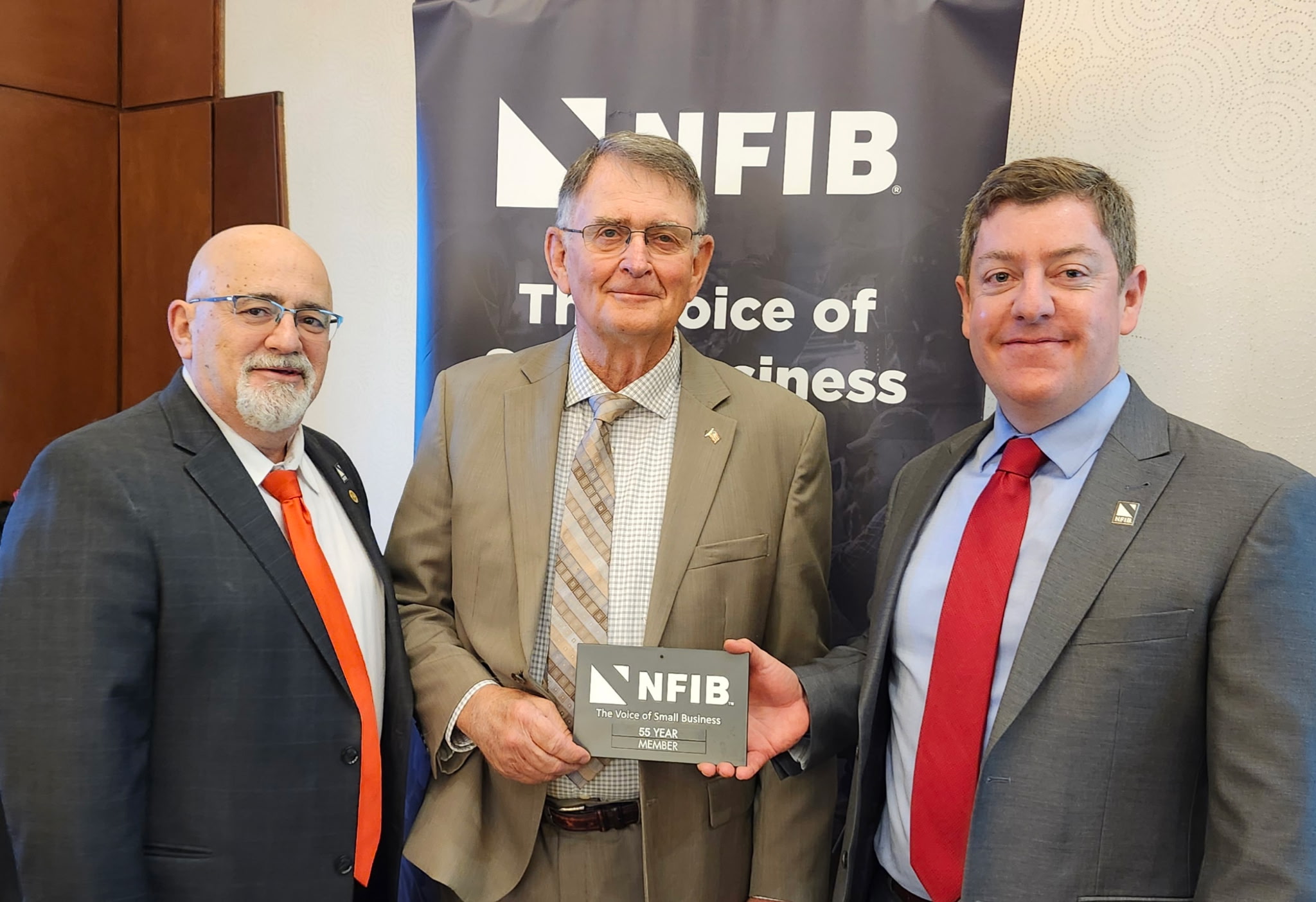

DES MOINES, Iowa (May 13, 2024) – The National Federation of Independent Business (NFIB), the nation’s leading small business advocacy organization, announced a new paid advertising campaign launching today featuring a radio ad thanking Senators Chuck Grassley and Joni Ernst for supporting efforts to make the 20% Small Business Deduction permanent by passing the Main Street Tax Certainty Act. “Small business owners want to see Congress take action and make the 20% Small Business Deduction permanent, and Senators Chuck Grassley and Joni Ernst have been strong leaders on this issue,” said NFIB Vice President of Federal Government Relations Jeff Brabant. “Main Street is at risk of a massive tax hike if the Small Business Deduction expires in 2025. Passing the Main Street Tax Certainty Act should be a top priority for Congress, and we are encouraged that this important bipartisan legislation has been introduced in both Chambers. We urge Congress to pass it and we thank Senators Chuck Grassley and Joni Ernst for their leadership for Iowa’s small businesses.” Listen to the radio ad thanking Senators Chuck Grassley and Joni Ernst here: https://youtu.be/wxxLoHc5YVU The 20% Small Business Deduction (Section 199A) allows small businesses organized as pass-throughs (S corporations, LLCs, sole proprietorships, or partnerships) the ability to deduct up to 20% of qualified business income and is scheduled to expire in 2025. NFIB President Brad Close recently penned an op-ed in the Wall Street Journal where he discussed the importance of the 20% Small Business Deduction for Main Street businesses nationwide.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

April 28, 2025

NFIB Illinois Opposes Inclusion of Mileage-Tax Pilot Program in…

HB 2963 includes a vehicle-mileage-tax pilot program for Illinois

Read More

April 28, 2025

Main Street Presses for Tort Reform, Tax Relief at Small Busine…

Small business owners from around the state will gather at the State House.

Read More

April 28, 2025

NFIB Arizona Making Final Push on Two Priority Bills

Business personal property tax exemption, litigation transparency close to…

Read More

April 28, 2025

Ohio Small Business Legislative Update

Learn the latest from the Ohio Legislature

Read More