April 1, 2022

Small Business Thanks Governor for Signing B&O Tax Credit Bill

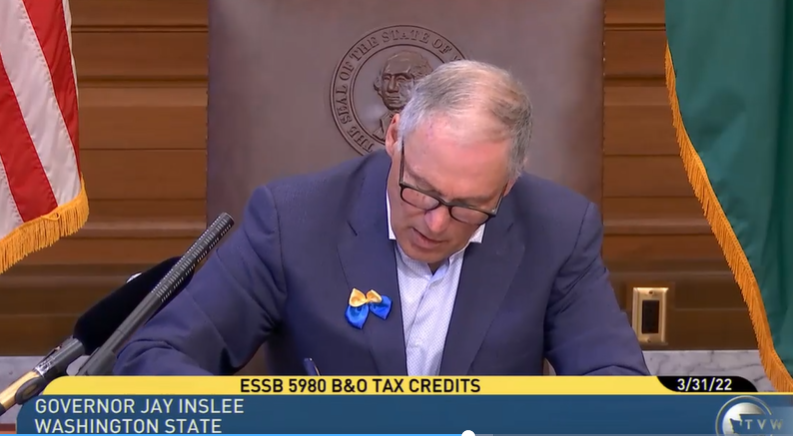

OLYMPIA, Wash., April 1, 2022—The state’s leading small-business association thanked Gov. Jay Inslee for his signing of Senate Bill 5980 into law March 31.

“Small businesses across our state need all the relief they can get,” said Patrick Connor, Washington state director for the National Federation of Independent Business (NFIB), the nation’s leading small-business association. “With record high job openings, fierce competition for workers, inflation, and supply-chain disruptions, these last few years have been brutal on Main Street businesses. By exempting firms with up to $125,000 in gross receipts from the Business & Occupations Tax (B&O), and expanding the Small Business Tax Credit to those enterprises earning nearly $250,000 annually, Senate Bill 5980 will provide welcome relief for some 276,000 small businesses. I would also like to thank Sen. Reuven Carlyle for his leadership on this issue.”

Connor also thanked the governor for signing Senate Bill 5873 into law March 11. It lessens the social tax increases for unemployment insurance (UI) scheduled for 2022 and 2023, as well as caps the social-tax modifier for small businesses employing 10 or fewer workers. That cap takes effect in 2023. This UI tax relief is estimated at roughly $265 million over the next year and a half.

“With B&O and UI tax relief now law and the defeat of bills that would have brought back ergonomics (HB 1837) and instituted a loser-pays requirement for workers’ compensation appeals filed by small employers (SB 5801), many Main Street businesses can breathe a little easier now that the Legislature has adjourned for the year,” said Connor.

Contact: Patrick Connor, Washington State Director, patrick.connor@nfib.org

or Tony Malandra, Senior Media Manager, anthony.malandra@nfib.org

Keep up with the latest Washington state small-business news at www.nfib.com/washington or by following NFIB on Twitter @NFIB_WA or on Facebook @NFIB.WA

###

For 78 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since our founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB Washington

Suite 505

711 Capitol Way South

Olympia, WA 98501

360-786-8675

NFIB.com/WA

Twitter: @NFIB_WA

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles