April 28, 2025

Legislature Adjourns: Big wins for small business, important updates to state law

The 114th Tennessee General Assembly adjourned for the year on April 22, passing a balanced budget and several laws that will impact your business. NFIB, once again, was in the trenches fighting for your right to own, operate and grow your business. Here’s what you need to know.

Property Tax Reform Passes

2025 was generally a quiet year for tax reform, after sweeping changes to our franchise and business taxes the prior two years.

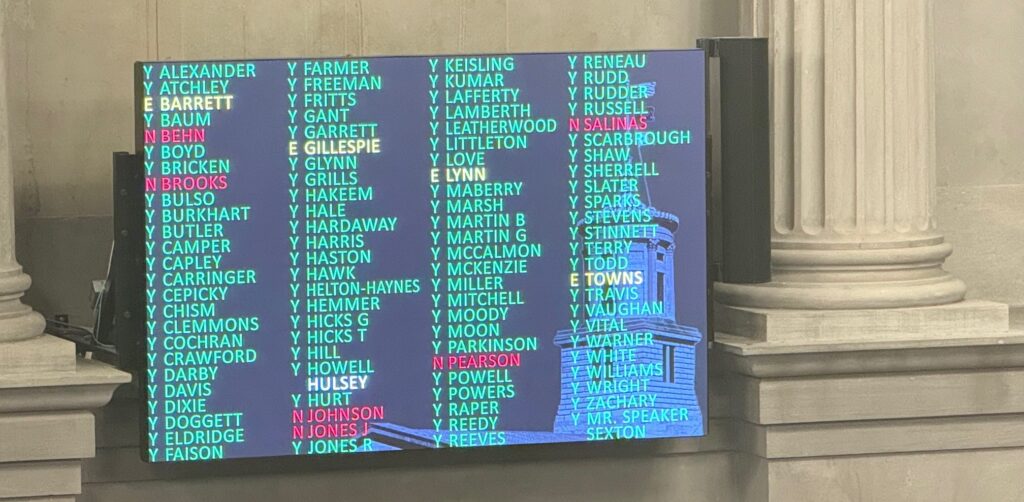

NFIB VICTORY: One major reform that did pass was SJR 1, which is a proposed constitutional amendment to ban the dormant statewide property tax, which is still on the state’s books. Both chambers easily met the required two-thirds threshold to put the measure on the 2026 ballot. This vote was an NFIB priority based on results from our Member Ballot.

Tort Damages Cap Increase Stopped

NFIB VICTORY: NFIB successfully opposed HB 5 (Rep. Gino Bulso, Franklin), which as introduced would have doubled the cap on non-economic damages from $750,000 to $1.5 million. The cap, which is already one of the highest in the nation, has been in place since the 2011 reform by Gov. Bill Haslam. The bill, which was later amended to do something else, would have increased insurance premiums and resulted in higher settlement demands.

Retail Crime Law Updated

NFIB VICTORY: HB 207/SB 240 addresses the growing problem of organized retail crime (ORC) by updating our law in three ways. It expands the time over which the aggregated value of theft exceeds $1,000 from 90 days to 180 days, adds important definitions of ORC, and increases the penalty by one classification if the offender engages in property destruction or uses a weapon during the offense and/or commits the offense while on bond or pretrial release.

Protection from Community Benefits Agreements

NFIB VICTORY: HB 1096/SB 1074 by House Speaker Cameron Sexton (Crossville) and Senate Majority Leader Jack Johnson (Franklin) provides employer protections when seeking to receive a state economic development incentive (EDI). An employer won’t have to enter into a community benefits agreement (CBA) that imposes obligations or conditions on the employer regarding employment practices, benefits, or operations that are not directly related to the performance of the employer’s duties under the EDI. Some local government contracts in Tennessee and elsewhere have had CBA’s that require an employer to agree to employ a unionized workforce for some or all jobs on a project and to make specific investments in the community.

Labor Law Uniformity

NFIB applauds passage of SB 674 (Sen. Brent Taylor, Memphis). The bill clarifies that the General Assembly preempts and occupies the entire field of regulating the terms and conditions of private employment and prohibits local governments from adopting or enforcing any law, rule, or policy that requires a term or condition of employment that exceeds or conflicts with state or federal law. The House version, HB 900 by NFIB member Rep. Chris Todd (Humboldt), will be debated next session.

Workers’ Compensation Reform

After receiving the great news that overall workers’ comp rates will drop for a 12th consecutive year, lawmakers made several updates to this section of the law. HB 128/SB 1309 removes the sunset of the vocational recovery portion of the subsequent injury and vocational recovery fund, increases the maximum number of terms judges can serve from three six-year terms to four six-year terms, and raises the age and experience requirements from 30 to 35 years of age and from five to seven years of workers’ comp experience, respectively.

Consumer Protection Act Bill Changed

NFIB originally had concerns with HB 911/SB 529, which would have inserted the term “unfair” into the catch-all provision in the Tennessee Consumer Protection Act (TCPA). We worked with the bill’s sponsors and interested parties to remove that proposal and other problematic sections of the bill, which later passed in modified form. NFIB believes lawmakers should bring specific proposals to update the TCPA, not vague terms that easily could be misconstrued or utilized against small businesses unfairly.

Human Smuggling/Immigration Bill

NFIB worked with the sponsors of SB 392/HB 322 to amend the bill to address a potential conflict between federal and state law. The term “should have known” that someone is here illegally was removed from the bill, at NFIB’s urging. Specifically, federal law requires all employers to accept I-9’s that appear to be “reasonably genuine”; if they don’t, they can be prosecuted under federal anti-discrimination law.

Of important note, the state legislation that passed creates a Class E felony (one to six years in jail, effective July 1, 2025) for human smuggling, which includes knowingly “harboring” an illegal immigrant with the intent of concealing them from law enforcement officials for “the purpose of commercial advantage or private financial gain.”

NFIB expects to hold an educational and compliance webinar for our members this summer to review this legislation and other recent updates in federal and state law.

Non-Compete Agreements to Be Studied

NFIB plans to work this summer with the sponsors of HB 1034/SB 995 and many interested parties. As drafted, the bill by NFIB members Rep. Rebecca Alexander (Jonesborough) and Senator Paul Bailey (Sparta) would have banned non-compete agreements (NCA), which are important to certain industries and businesses that have proprietary information. However, we recognize there are situations where NCA’s can cause undue burdens on individuals and their families. Lawmakers plan to consider changes to the law again next year.

Professional Privilege Tax

HB 189/SB 397 by NFIB members Rep. Ron Gant (Piperton) and Sen. Paul Rose (Covington), which would repeal the $400 annual professional privilege tax on attorneys and financial advisers, once again didn’t gain traction this year. NFIB continues to support this effort.

Other Bills of Interest

Tennessee passed a $59 billion 2025-2026 budget bill, its only constitutional requirement each session.

NFIB VICTORY: Two bills (SB 1190 and SB 1357) that would have increased the minimum wage significantly did not pass.

The proposed Pay Stub Protection Act stalled in both chambers but likely will be reconsidered in 2026.

A food safety update bill passed after several compromises were made.

The Voluntary Portable Benefits Plan Act, which allows a public or private entity to contribute funds voluntarily to a portable benefit plan as a form of compensation to an independent contractor, passed.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles