The NFIB Research Foundation has collected Small Business Economic Trends data with quarterly surveys since the 4th quarter of 1973 and monthly surveys since 1986. Survey respondents are drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in May 2024.

Small Business Optimism Index

May 2024 Report:

Small Business Uncertainty Index Reaches Highest Level Since 2020

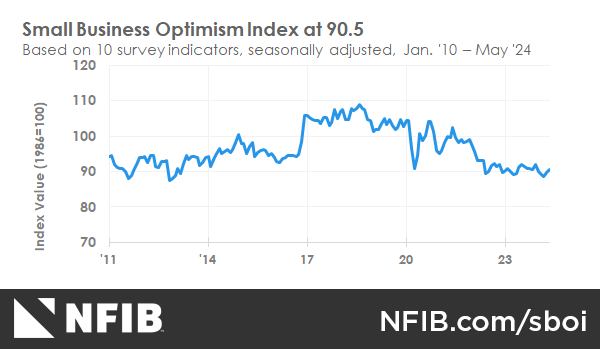

The NFIB Small Business Optimism Index reached the highest reading of the year in May at 90.5, a 0.8-point increase but still the 29th month below the historical average of 98. The Uncertainty Index rose nine points to 85, the highest reading since November 2020. Twenty-two percent of owners reported that inflation was their single most important problem in operating their business, unchanged from April and the top business problem among owners.

“The small business sector is responsible for the production of over 40% of GDP and employment, a crucial portion of the economy,” said NFIB Chief Economist Bill Dunkelberg. “But for 29 consecutive months, small business owners have expressed historically low optimism and their views about future business conditions are at the worst levels seen in 50 years. Small business owners need relief as inflation has not eased much on Main Street.”

Key findings include:

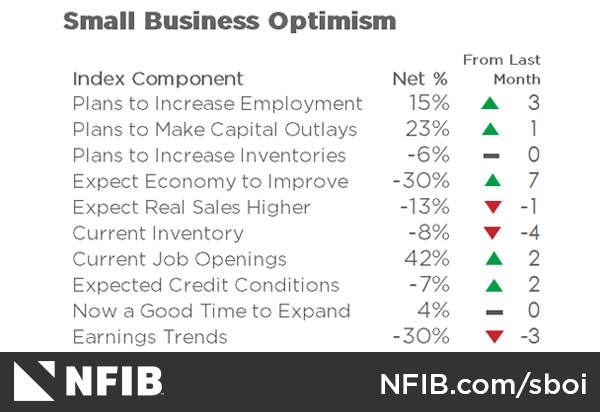

- A net negative 8% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in May, down four points from April and the lowest reading since October 1981.

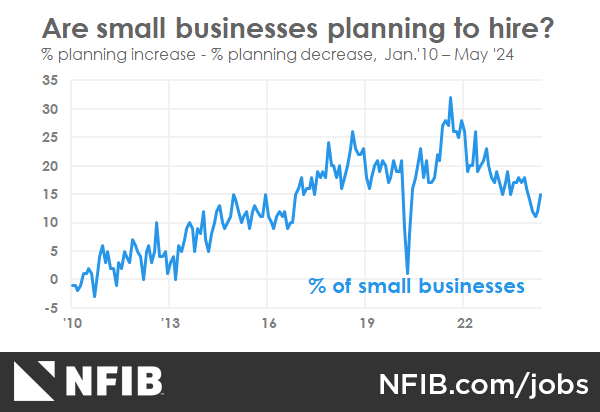

- Owners’ plans to hire rose three points in May to a seasonally adjusted net 15%, the highest reading of the year.

- Seasonally adjusted, a net 28% plan price hikes in May, up two points from April.

- Six percent of owners reported that financing was their top business problem in May, up two points from April. The last time financing as a top business problem was this high was in June 2010.

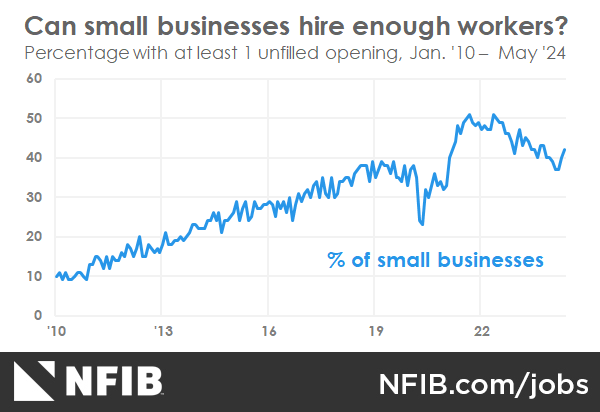

As reported in NFIB’s monthly jobs report, a seasonally adjusted net 18% plan to raise compensation in the next three months, down three points from April and the lowest reading since March 2021. Forty-two percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period.

Fifty-eight percent of owners reported capital outlays in the last six months, up two points from April. Of those making expenditures, 40% reported spending on new equipment, 25% acquired vehicles, and 16% improved or expanded facilities. Eleven percent spent money on new fixtures and furniture and 6% acquired new buildings or land for expansion. Twenty-three percent (seasonally adjusted) plan capital outlays in the next six months, up one point from April.

A net negative 14% of all owners (seasonally adjusted) reported higher nominal sales in the past three months. A net percent of owners expecting higher real sales volumes fell one point to a net negative 13% (seasonally adjusted).

The net percent of owners reporting inventory gains fell one point to a net negative 7%. Not seasonally adjusted, 11% reported increases in stocks and 15% reported reductions.

A net negative 8% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in May, the lowest reading since October 1981. A net negative 6% (seasonally adjusted) of owners plan inventory investment in the coming months, unchanged from April.

The net percent of owners raising average selling prices was unchanged from April at a net 25% seasonally adjusted. Twenty-two percent of owners reported that inflation was their single most important problem in operating their business. Unadjusted, 12% reported lower average selling prices and 40% reported higher average prices.

Price hikes were the most frequent in the retail (55% higher, 6% lower), finance (50% higher, 3% lower), construction (42% higher, 9% lower), manufacturing (42% higher, 12% lower), and services (37% higher, 6% lower) sectors. Seasonally adjusted, a net 28% plan price hikes in May.

Seasonally adjusted, a net 37% reported raising compensation, down one point from April. A seasonally adjusted 18% plan to raise compensation in the next three months, down three points from April and the lowest reading since March 2021. Ten percent of owners cited labor costs as their top business problem, only three points below the highest reading of 13% reached in December 2021. Twenty percent said that labor quality was their top business problem, just behind inflation as the number one issue.

The frequency of reports of positive profit trends was a net negative 30% (seasonally adjusted), three points worse than April and a very poor reading. Among owners reporting lower profits, 32% blamed weaker sales, 15% blamed the rise in the cost of materials, 14% cited labor costs, and 11% cited lower selling prices. For owners reporting higher profits, 41% credited sales volumes, 23% cited usual seasonal change, and 10% cited higher selling prices.

Three percent of owners reported that all their borrowing needs were not satisfied. Twenty-nine percent reported all credit needs met and 58% said they were not interested in a loan. A net 6% reported their last loan was harder to get than in previous attempts.

Six percent of owners reported that financing was their top business problem in May, up two points from April. The last time financing as a top business problem was this high was in June 2010.

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in May 2024.

LABOR MARKETS

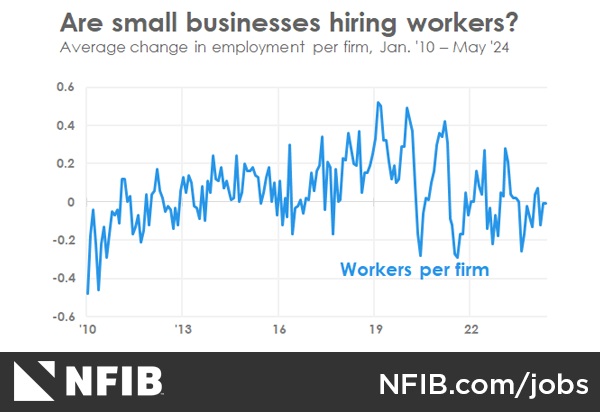

Forty-two percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, up 2 points from April. Thirty-seven percent have openings for skilled workers (up 3 points) and 14 percent have openings for unskilled labor (down 4 points). The difficulty in filling open positions is particularly acute in the construction, manufacturing, and transportation sectors. Job openings in construction were down 1 point from last month and over half of the firms (54 percent) have a job opening they can’t fill. Openings were the lowest in the wholesale and agriculture sectors. Owners’ plans to hire rose 3 points in May to a seasonally adjusted net 15 percent, the highest reading of the year. Overall, 60 percent reported hiring or trying to hire in May, up 4 points from April. Fifty-one percent (85 percent of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill (unchanged). Twenty-nine percent of owners reported few qualified applicants for their open positions (up 1 point) and 22 percent reported none (down 1 point). Reports of labor quality as the single most important problem for business owners rose 1 point to 20 percent. Labor cost reported as the single most important problem for business owners decreased 1 point to 10 percent, only 3 points below the highest reading of 13 percent reached in December 2021.

CAPITAL SPENDING

Fifty-eight percent reported capital outlays in the last six months, up 2 points from April. A recovery in investment is needed to support stronger productivity, but this is unlikely to occur while interest rates remain high, and more owners anticipate slower sales. Long term, the worker shortage has given firms an incentive to invest in labor saving technology. But, overall, capital spending is sluggish and not yet back to pre-pandemic levels. Of those making expenditures, 40 percent reported spending on new equipment (up 2 points), 25 percent acquired vehicles (up 1 point), and 16 percent improved or expanded facilities (unchanged). Eleven percent spent money on new fixtures and furniture (unchanged) and 6 percent acquired new buildings or land for expansion (unchanged). Twenty-three percent (seasonally adjusted) plan capital outlays in the next six months, up 1 point from April. A more positive view of the future economy and economic policy would help stimulate longer term investment spending, but currently owners’ views about the future are not supportive and financing costs are very high. Investment is needed to address labor supply chain problems which still persist in the current environment.

INFLATION

The net percent of owners raising average selling prices was unchanged from April at a net 25 percent seasonally adjusted. Twentytwo percent of owners reported that inflation was their single most important problem in operating their business, unchanged from April. Unadjusted, 12 percent (down 1 point) reported lower average selling prices and 40 percent (down 1 point) reported higher average prices. Price hikes were most frequent in the retail (55 percent higher, 6 percent lower), finance (50 percent higher, 3 percent lower), construction (42 percent higher, 9 percent lower), manufacturing (42 percent higher, 12 percent lower), and services (37 percent higher, 6 percent lower) sectors. Seasonally adjusted, a net 28 percent plan price hikes in May (up 2 points).

CREDIT MARKETS

Three percent of owners reported that all their borrowing needs were not satisfied, unchanged from April. Twenty-nine percent reported all credit needs met (up 1 point) and 58 percent said they were not interested in a loan (down 2 points). A net 6 percent reported their last loan was harder to get than in previous attempts (down 2 points). Six percent reported that financing was their top business problem in May (up 2 points). The last time financing as a top business problem ranked this high was June 2010. A net 20 percent of owners reported paying a higher rate on their most recent loan, down 1 point from April. The average rate paid on short maturity loans was 9.0 percent, down 0.3 of a point from last month. Thirty-one percent of all owners reported borrowing on a regular basis, unchanged from April.

COMPENSATION AND EARNINGS

Seasonally adjusted, a net 37 percent reported raising compensation, down 1 point from April. A seasonally adjusted net 18 percent plan to raise compensation in the next three months, down 3 points from April and the lowest reading since March 2021. Ten percent cited labor costs as their top business problem, down 1 point from April and only 3 points below the highest reading of 13 percent reached in December 2021. Twenty percent said that labor quality was their top business problem (up 1 point), remaining just behind inflation as the number one issue. The frequency of reports of positive profit trends was a net negative 30 percent (seasonally adjusted), 3 points worse than April. Among owners reporting lower profits, 32 percent blamed weaker sales, 15 percent blamed the rise in the cost of materials, 14 percent cited labor costs, and 11 percent cited lower selling prices. For owners reporting higher profits, 41 percent credited sales volumes, 23 percent cited usual seasonal change, and 10 percent cited higher selling prices.

SALES AND INVENTORIES

A net negative 14 percent of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 1 point from April. The net percent of owners expecting higher real sales volumes fell 1 point to a net negative 13 percent (seasonally adjusted). The net percent of owners reporting inventory gains fell 1 point to a net negative 7 percent. Not seasonally adjusted, 11 percent reported increases in stocks (down 1 point) and 15 percent reported reductions (down 2 points). A net negative 8 percent (seasonally adjusted) of owners viewed current inventory stocks as “too low” in May, down 4 points from April and the lowest reading since October 1981. A net negative 6 percent (seasonally adjusted) of owners plan inventory investment in the coming months, unchanged from April.

COMMENTARY

The news is now dominated by political events rather than economic news and analysis. The presidential election is months away, and time is running short for the candidates. The economy appears to be slowing down, the inflation rate appears to be headed toward 2%, but the price level (based on the CPI) is 20% higher than it was four years ago. Overall, the net impact is that real incomes fell about 2.5% over that period. However, the impact was not spread evenly. Huge increases in income and wealth were enjoyed by asset holders (stocks, real estate, etc.) but not shared with most of the population who watched groceries, rent, house prices, and auto insurance surge.

The small business sector is credited with the production of over 40% of GDP and employment, so its condition is central to the performance of the economy. Optimism there has been in the dumps since early in 2020. Views about future business conditions are at the worst levels seen in 50 years. Investment (capital spending) remains anemic, lowering prospects for productivity improvements. The government’s share of GDP has grown as has government employment, but hiring more IRS agents is not going to improve consumer well-being. Unsustainable debt levels, including the national debt, risk destabilizing events in financial markets. And, the election promises to bring major changes in the tax and regulatory environment, regardless of who wins. All of this presents a very uncertain outlook for small business owners and uncertainty is the enemy of progress.

Just knowing NFIB is on your side is cause for optimism

Let’s chat for 10 minutes and we’ll help you understand all the ways NFIB is advocating for you and your business.