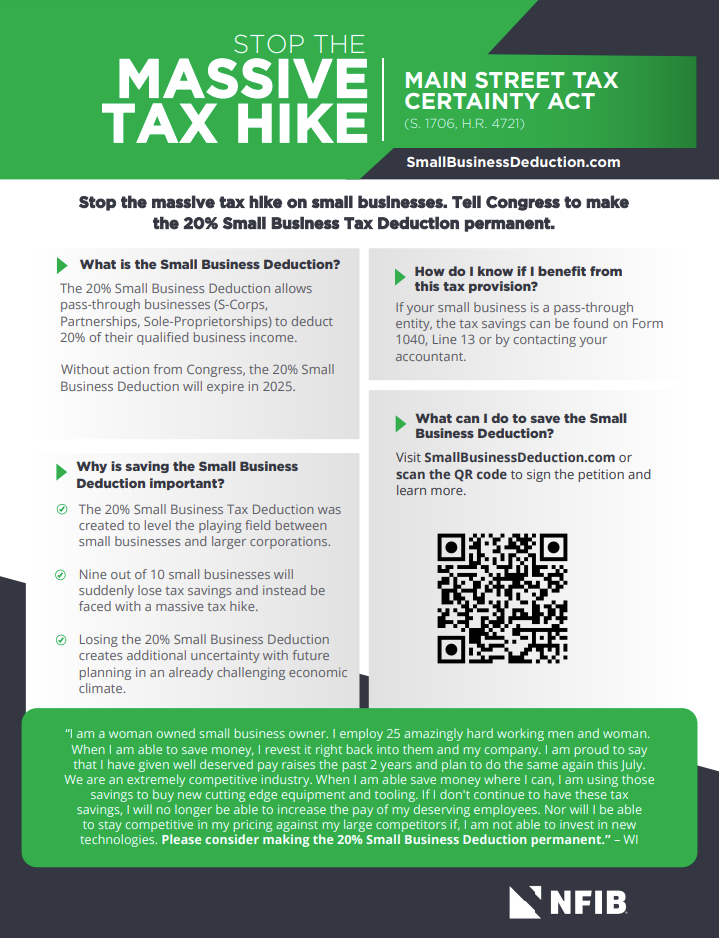

NFIB supports making the 20% Small Business Tax Deduction (Section 199A) permanent.

Created under the 2017 Tax Cuts and Jobs Act (TCJA), the 20% Small Business Deduction aims to provide tax relief for America’s 33 million small businesses. The 20% Small Business Deduction allows owners of most pass-through businesses to claim a 20% tax deduction on business income.

Since its inception, the 20% Small Business Deduction has been a lifeline for small business owners. According to the U.S. Small Business Administration’s Office of Advocacy, 77% of small employers and more than 90% of small businesses are organized as pass-throughs. IRS data shows that 25.9 million small businesses utilized this deduction in 2021. Small businesses are the foundation of the U.S. economy, and the utilization of the 20% Small Business Deduction is not just good for these businesses – it is good for the U.S. economy.

According to a recently published EY Study on the importance of the deduction, permanently extending the 20% Small Business Deduction would increase jobs in the small business sector by 1.2 million jobs each year and by 2.4 million annually every year thereafter. The report also found that extending the 20% Small Business Deduction would result in a $750 billion GDP increase in the small business sector over the first ten years, and a $150 billion increase annually after that.

This deduction will expire at the end of the year if Congress fails to act.